Escape Velocity

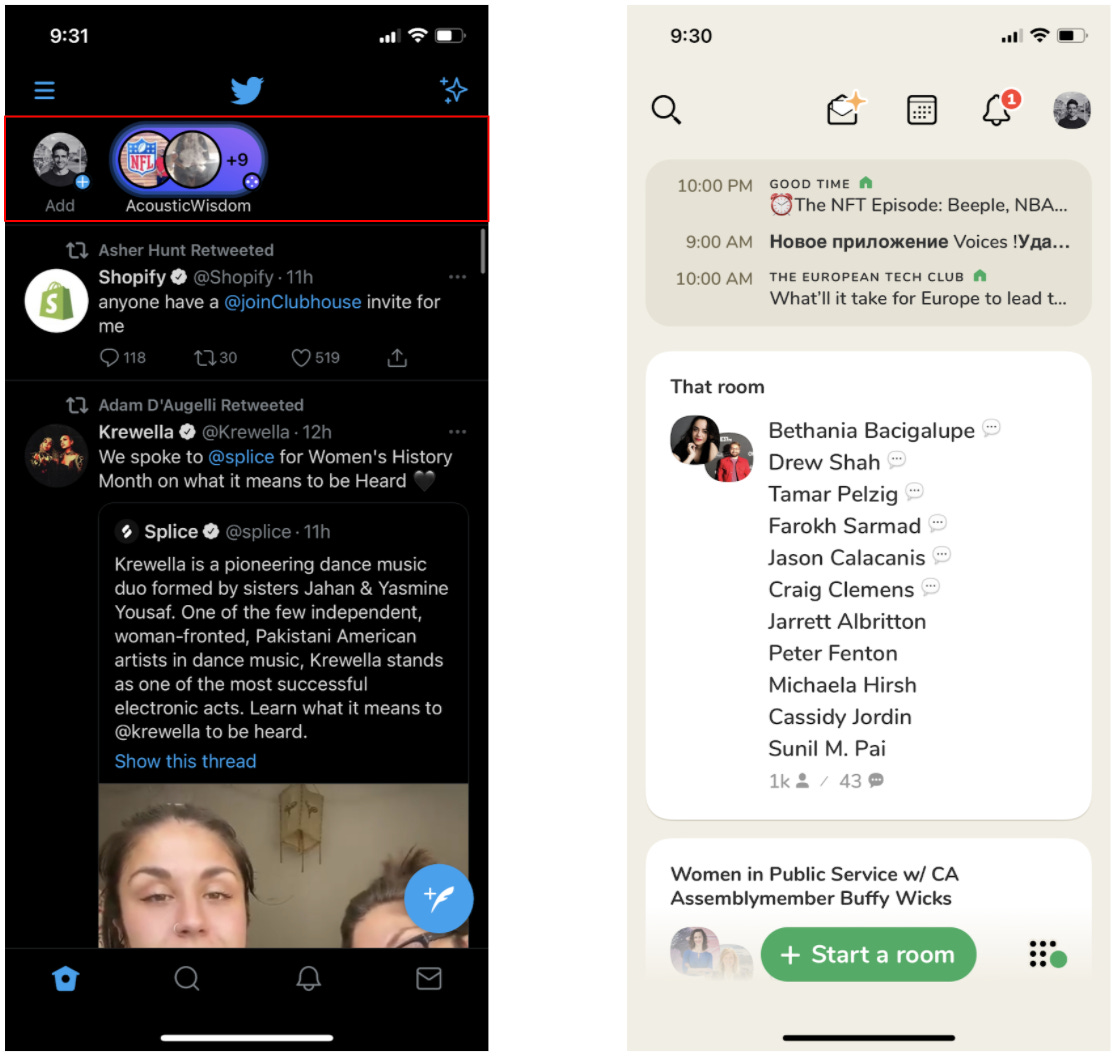

Clubhouse is the fastest-growing social network to emerge from the West in this past decade. As shown in the image below, it’s also a rare example of a social product that is synchronous, public by nature, and centered around real user identities.

It’s easy to see why the company has been so successful. As many have stated, the company has democratized access to a new medium in audio. Their product has made it simple to manage a large audience without being visually overwhelming, in essence “competing for the ears, not the eyes”. They have layered on asynchronous features like presence, public calendars, and notifications that drive retention and allow for liquidity to be built in the app. They have also built a unique growth engine centered around leveraging the contact book and manufacturing artificial scarcity. By requiring invites to join the app and capping room sizes, they have stimulated significant virality and word-of-mouth.

Simply put, Clubhouse has reached escape velocity. It took Facebook, Instagram, and Twitter 29 months, 15 months, and 21 months respectively to reach 8 million monthly downloads on mobile. Clubhouse has done so in less than 12 months**.

I see only two things that could stop Clubhouse at this point. A potential decline in usage post-COVID as the 24 Hour Day possibly shifts again and/or competition from existing social networks that layer on audio as a new way to engage.

Persistence of Live Audio

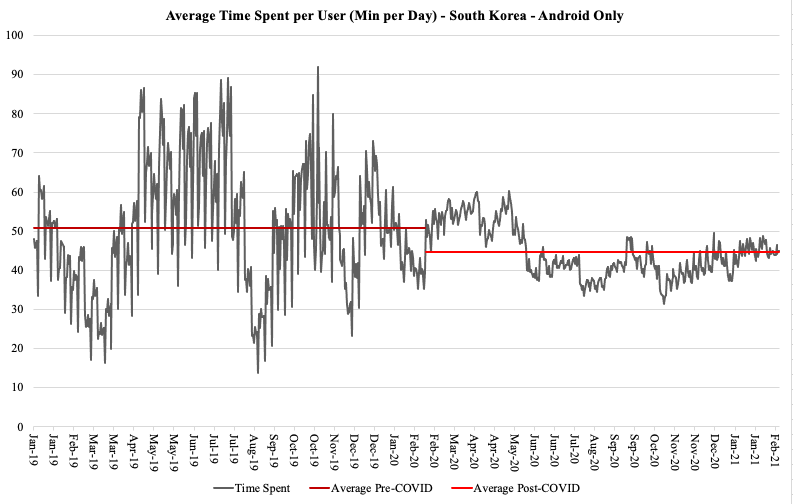

There have been a few comparable live audio products to Clubhouse that have risen to prominence even before the pandemic. The best example is Spoon in Korea. Spoon listeners were already spending upwards of 45 minutes per day in the app while Spoon creators were hosting rooms for roughly an hour per day. This level of engagement has persisted throughout the pandemic with marginal differences in time spent. In addition, new Spoon users are retaining at similar rates to older cohorts, further reinforcing the similarity between pre-pandemic and post-pandemic behavior. This also highlights that user retention for live audio products is not a problem once distribution has been solved and user behavior has been established.

Audio-first platforms have a few notable advantages compared to other social networks. They benefit from a higher creation rate compared to longform video networks like YouTube or livestreaming platforms like Twitch. Upwards of 10% of users contribute on live audio platforms (speaking and/or hosting rooms) compared to <1% of users creating on YouTube and <2% of users streaming on Twitch. This will likely increase as Clubhouse starts offering paid monetization features to incentivize more content creation (and higher quality content).

Live audio platforms also benefit from usage in less competitive parts of the day. For example, Spoon sees a majority of its user engagement happening between 9pm and 2am. Clubhouse likely benefits from similar dynamics, albeit not as late into the night, and they will continue to capture an outsized share of time relative to other social networks in this daypart. In reality, Clubhouse has a much larger opportunity than Spoon. Spoon initially focused on solving loneliness for younger users whereas Clubhouse has been able to onboard celebrities and turn their product into a mass-market phenomenon.

All signs point to live audio persisting in a post-COVID world.

Framing the Competitive Threat

The bigger challenge for Clubhouse is emerging competition from large platforms. Given the public nature of interactions, the most relevant competitors will likely be Facebook, Twitter, and potentially Instagram. Clubhouse’s exposure to this threat centers around the following:

Is Clubhouse building its own distinct graph or are they just piggybacking off of existing platforms?

How much of Clubhouse’s growth has come from Twitter, Facebook, and other platforms vs. through in-app referrals and word-of-mouth?

Does live audio merit its own standalone platform or can it be replicated as a feature inside of an existing network?

How much can platforms like Twitter and Facebook limit Clubhouse’s future user growth?

A New Graph

While it’s still early to make a definitive statement, there are signs that Clubhouse is succeeding in building a distinct social graph. Germany serves as a great example. It is Clubhouse’s third-largest market in terms of cumulative app downloads. The app quickly became the #1 overall app in the German iOS store in January (today it is #52) and one of the most searched queries on Google. This is notable as only 6% of the population uses Twitter and only 40% use Facebook (compared to 70% in the US). As of February, Clubhouse received more app downloads in Germany than Facebook, Snapchat, or Twitter. And they did so without even having an Android app in a country where 65% of people use Android.

This holds true in other countries as well. There are 32 countries where Clubhouse has garnered greater than 10% market share in terms of downloads (market share = combined number of downloads in February for Clubhouse, Discord, Facebook, Instagram, Snap, TikTok, and Twitter). In 19 of those countries, Clubhouse is garnering 2x the market share of Twitter***. In 3 countries, Clubhouse is garnering 2x the market share of Facebook****.

If we need proof that Clubhouse is building a distinct graph and not just attracting users who are on other social platforms, Germany might just be the smoking gun.

Captaining Their Own Ship

The second question revolves around Clubhouse’s reliance on existing social platforms for growth. There is always an existential fear that these networks can shut off external links to apps and/or reduce their visibility in feeds.

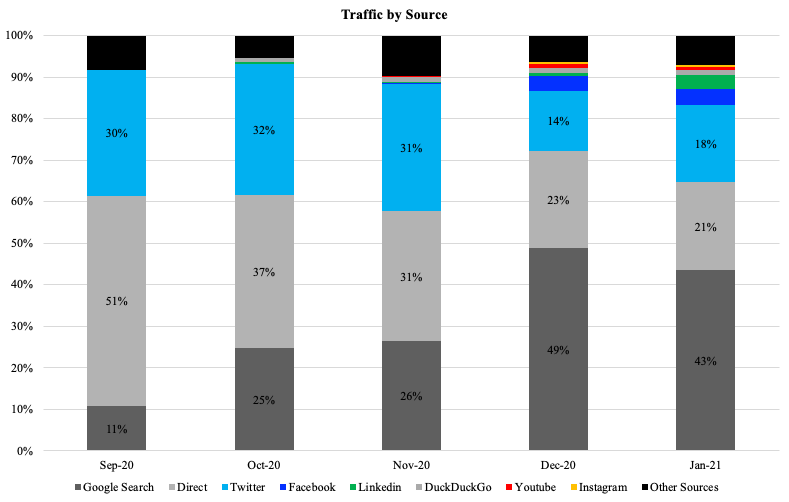

While attribution is hard, we can look at the sources of traffic to Clubhouse’s website for a rough estimation of how users are hearing about the product. As of January, traffic from social platforms accounted for only 27% of total traffic. Twitter has fallen dramatically as a source accounting for 18% of total traffic, despite overall traffic increasing >260x during this time. The vast majority of traffic has come from Google or direct traffic, signaling that people are hearing about the product through word-of-mouth.

Take this as one data point but it looks like Clubhouse is not dependent on existing social networks for user growth.

An Audio-First Experience

As we’ve seen with Twitter Spaces, it’s likely that existing platforms will layer on audio as a new feature rather than launch a standalone product. This makes sense given their previous track records of doing so (for Twitter, see Vine and Periscope).

While Twitter Spaces is interesting and will have no issue driving awareness of audio-based communication, I worry the experience will be subpar relative to Clubhouse given the limited real estate it can consume. Notably, Twitter Spaces today lacks presence and discovery, which are two of the most powerful drivers of synchronous interaction. I also wonder if platforms like Twitter and Facebook will struggle with classic innovator’s dilemma as any engagement shifted from feeds to audio will inevitably cannibalize advertising revenue. The counterargument would be that audio could drive incremental engagement to these platforms and that users will multi-task (listen to a Space while scrolling through the feed).

Regardless, Clubhouse has no competing incentives and can be far more aligned with creators and listeners. Just like Snapchat differentiated from Instagram with messaging, a novel camera, AR features, and a Gen Z audience, I believe Clubhouse will leverage presence, discovery, and a creator-centric monetization strategy to solidify its position.

Sucking the Oxygen Out of the Room

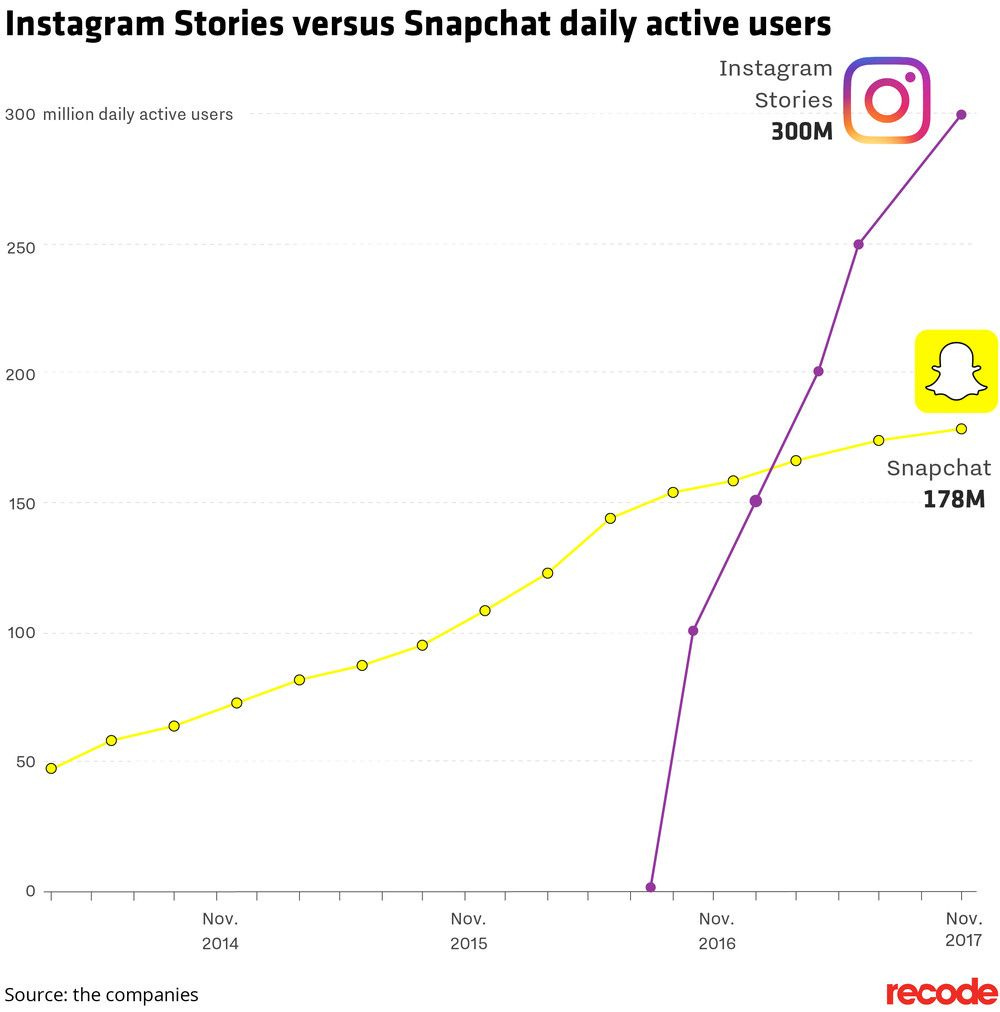

All signs show that Clubhouse will be able to co-exist with competing products. The real question for me is how much Twitter and Facebook’s efforts could limit Clubhouse’s future growth. I see many parallels to when Instagram replicated Snapchat Stories as a feature in late 2016. Although Instagram didn’t take users away from Snapchat, they did remove the motivation for Instagram’s users to try Snapchat. This limited Snapchat’s growth — DAU growth slowed from 50% per year from 2014 to 2016 to 14% per year from 2016 onwards.

A similar thing could happen with Clubhouse. It’s clear Twitter and Facebook are taking this opportunity seriously given the speed at which they’re moving and it will be interesting to see how Clubhouse responds. One way to compete would be to further accelerate their growth and reduce the relative scale advantage of their competitors. They could do so by leveraging their war chest ($100 million+) to start investing in paid acquisition (TikTok anyone?) and/or paying for new creators to join their platform and bring their audiences (OnlyFans anyone?). Another more organic approach would be to leverage their real estate advantage and alignment with users to push new features that would be tough for competitors to replicate. Lastly, they could use their capital and data advantage to lock in high-performing creators on Clubhouse to advantageous exclusives before the value of these creators is fully known to the outside world.

✌️ Leave Quietly

Given the exceptional growth of Clubhouse, the unique graph they are building, their ability to control user growth, the audio-first nature of the product, and the innovator’s dilemma competitors will face, I believe Clubhouse has a strong likelihood to become a permanent fixture in the social landscape. Android alone will double Clubhouse’s existing userbase and put them on a path to tens of millions of active users. If they can cross the 50 million MAU ceiling (which few social products have achieved) before any serious competition emerges, it will be impossible for anyone to displace them.

Follow me @dino on Clubhouse or @dinobecirovic on Twitter.

* Discord, Piñata Farms, and Roblox are Index portfolio companies.

** Obviously there are a lot more smartphones now which helps.

*** These countries include Moldova, Kyrgyzstan, Norway, Sweden, Armenia, Uzbekistan, Taiwan, Hong Kong, Mongolia, Belarus, Estonia, Italy, Macau, Qatar, Japan, Jordan, Slovakia, South Korea, and Malaysia.

**** These countries include Japan, Norway, and Sweden.

Love the article. Though I feel conflating the growth of text/image based apps vs audio is not as justified. There is a supposition that after reaching x amount of users - clubhouse would explode just as Snap, Insta, Facebook did. Being a different format, with different characteristics, could limit the growth potential.

1. Facebook, Snap, Insta, all three started via young college going audiences in their early growth. Growth was slightly slow but it meant they could acquire new users, and those who graduated from college would stick given their social graph is on the platform too. Tiktok has been doing the same now as well. CH has not been doing it, instead they focused on celebrities (in a particular field, not just entertainment). How do you think that factor would play out?

2. Hard to say the social graph is different based on just comparing visits to website or downloads. Maybe the only publicly available proxy, but does not seem accurate.

3. Audio has a low dunbar number ie. people tend to have fewer audio based connections compared to text/images or even short form video. How do you think that affects the growth?